347/365

If you need me on Monday mornings, you can generally find me at my desk on my laptop working on our budget. This is a ritual I’ve developed in order to keep all of our complicated finances under control, especially important since I started travel hacking. Routine is key. Let me take you on a tour of my Monday morning budget routine so that you can get an idea of what it takes to keep this boat afloat!

Start with the Spreadsheet

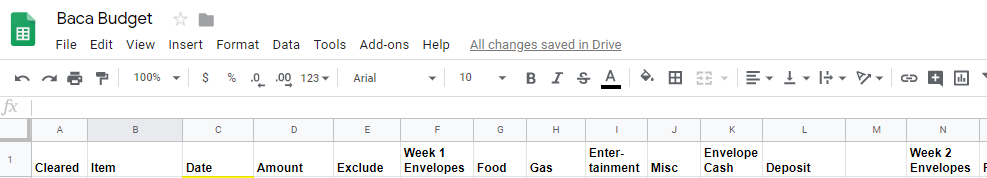

Several years ago, in early 2015 in fact, I started a spreadsheet to keep track of all of our expenses. A few months prior to that, I had downloaded budget binder printables from a website, but it was too much with all the paper and manual calculations. Also, I was just getting into credit card rewards, so I needed something that would be less cumbersome and more functional. So I made a spreadsheet on Google Docs.

Spreadsheets Are Awesome!

I love spreadsheets. I use them often; from helping me plan a trip to keeping track of our budget to helping me organize my blog posts, spreadsheets are darn useful tools. What makes them even better is that you can use them to compare values or carry a balance from one sheet to another. For my budget, I was especially happy not to have to do all of the calculations myself each week.

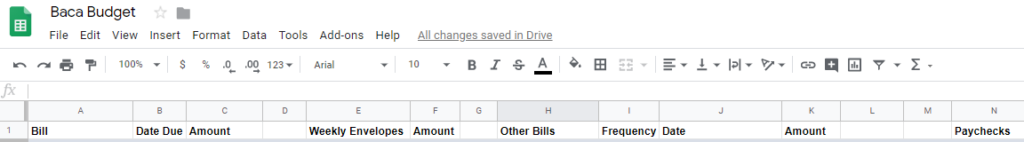

Designing My Spreadsheet

I modeled my budget spreadsheet after the budget pages I had been using. One sheet has all of our bills listed by due dates for the month, plus quarterly or annual bills listed on the side. Another sheet tracks my savings accounts and which credit cards are paid from each one, listed by due date. The rest of the pages consist of biweekly sheets dating back to February, 2015, when I started. See, I knew that because I could scroll through the pages to find the first one!

Keeping it Current

I keep a blank template to easily add more biweekly sheets using the duplicate feature. Every few months or so, I will take a few minutes to add the next couple of months of sheets, but not too many that I can’t see the current date in my window. I then copy and paste each sheet’s bills that will be due for that two week period from my bills sheet. I liken this to printing off more sheets and adding the dates to them, except that I don’t have to waste any paper or cramp my hand with writing!

Automate EVERYTHING!

This is a key to keeping your sanity with budgeting. If a bill has an autopay feature, use it! This is especially crucial for procrastinators like me. The bank won’t procrastinate an autopay. It will come out regardless of whether you are on vacation or you’ve just decided not to touch the bills this week. Every possible bill we have is set to autopay, from our mortgage to the solar panel payment to each and every credit card bill, obviously set to pay the balance in full each month. Autopay is my very good friend. I should take it out for coffee one of these days!

Using Sallie Mae

Since we have so many credit cards, it takes a good system to manage them all. I found a system that I like using the online bank Sallie Mae. I transfer any money I’ll need to cover credit card balances into these accounts from our checking accounts. The reason for this is because our checking accounts accrue minimal interest, but Sallie Mae gets 2.15% APY (as of this writing). So instead of our money sitting in our checking account for the month before the credit card bill is due, I transfer it to Sallie Mae.

Six Withdrawal Limit

The reason I have to have more than one savings account is that each one is limited to six withdrawals per month, so I can’t have more than six credit card accounts draw from any one savings account. I usually further limit it to five so that I have a buffer in case I need to transfer from one account to another in a pinch. I was worried that Sallie Mae would have a limit on the number of accounts I can have open, but so far it seems unlimited. I even opened one simply to park a $25 deposit our tenant put on the pool key. When I return the money, it will include interest.

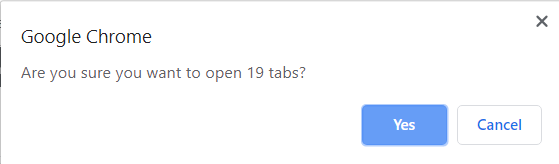

Open Those Tabs

My husband makes fun of the millions of tabs open on my computer. I say it helps me keep organized and accountable to tasks I need to do, but he is right. It’s probably not the best practice. One area I have under control (tabs-wise) is my weekly budgeting chore. I keep all of the websites I will need to do the budget, including the spreadsheet on Google Docs, under one folder in my bookmarks bar. All I have to do is right click on the folder and tell Google to open all of the tabs in a new window. It always asks that insidious question, “Are you sure you want to open 19 tabs?” Yes, Google Chrome, I do. It feels good to close that window with all those open tabs when I have finished balancing the budget!

Checking Balances

My first task on Mondays is to check the balances in my Sallie Mae accounts. Luckily, I can access them in one login, and see each account’s balance on one page. I update this number on my credit card sheet, but I have to be careful because Sallie Mae will put any funds I’ve transferred on hold for five business days, so I have to make sure I enter the available balance, not current balance. I do like that even though they put the funds on hold, they start accruing interest immediately.

Mint

Next, I log into Mint to check our transactions for the week and balance them against Goodbudget and that week’s receipts (especially important when using a gift card to pay since it won’t be logged in Mint). This is where I can put a stop to any fraudulent activity or catch mistaken transactions. Once, Safeway had accidently charged our card, but I was able to catch it early. Another time, someone had used one of our cards to buy a computer online. We were able to notify the bank as the transaction was pending, so hopefully the thief didn’t get his order. I also mark any bills that were paid and update them in my biweekly sheet. Credit card payments also get zeroed out on the credit card sheet until I have a new balance due amount.

Credit Card Accounts

I log into all of my active credit card accounts next. This has become a bit harder with Chase and American Express recently because their websites don’t like Google Chrome, so I have to use Incognito Mode in order to log in. Very odd. Anyway, I glance over recent transactions and update my credit card sheet with any new balances due. If I’m tracking transactions for a minimum spend or Freedom rotating category, I’ll add those to my other spreadsheet. For Chase and Amex, I also check for Offers and add new ones to my cards.

Transfer Money

Almost every week, I need to transfer money from one account to another. First, I determine which Sallie Mae accounts will be short with the new credit card balances entered. Then I determine how much money I need to keep in our checking account to cover expenses like utilities and mortgage payments that can’t be paid with a credit card. Next, I will transfer the needed amount to each Sallie Mae account and note it at the bottom of my credit card sheet so I know I have money coming in to cover the balances by the time they are due.

Export Goodbudget Transactions

We use Goodbudget to track our main discretionary spending. This is in lieu of cash envelopes in those popular budgeting systems. Our virtual envelopes include Food/Groceries, Entertainment, Gas, and Miscellaneous. Once I have everything entered from Mint and receipts, I will export each envelope’s transactions for the week to my budget spreadsheet. This helps me track our spending on a day to day basis better.

6 Steps to Success

So that seems insanely complicated, but without distractions and with a good system in place, it can take less than an hour each week. Here are the steps:

- Open a budgeting window with any websites needed in one window

- Check savings balances in Sallie Mae and update credit card sheet

- Log into Mint and check transactions for the week, making sure they are entered into the budget spreadsheet or Goodbudget

- Log into credit card accounts to check balances, track spending, and check for Offers

- Transfer money from checking accounts to savings accounts

- Export transactions from Goodbudget to spreadsheet

Make It a Routine

I like to start the week on Monday, but you could pick a day that works for you. The idea is to get into a solid routine that is consistent. This is how you avoid mistakes. I know that if I skip a week, my transfers won’t get there in time, and then I’m scrambling to make payments manually. Yuck! I hate doing that. Automation is the key to making this process as smooth as possible! You can also make a checklist of budgeting tasks until you are such a pro that you know exactly what you need to do each week!