Day 1/365 2018-2019

The first thing you need to do when dealing with any kind of financial goal is to look at your finances. Seems simple, right? Well, I imagine there are a lot of people out there who don’t really know where their money is going at any given moment. They simply spend until the bank account is empty, or even worse, until they hit the limit on their credit cards. Yikes!

Mint

When our family decided that we wanted to make travel a priority, we first looked to Mint. Mint is an account aggregate where you enter your information, and Mint puts it all in one place for you. I log in to Mint every Monday morning and consolidate my receipts with any transactions in Mint. It saves me from having to log into multiple accounts to get a snapshot of where our money is coming in and going out. Sometimes I even find surprise transactions that I can deal with before they hit my monthly statement, sometimes before they even come out of pending status!

Now, the great thing about Mint, especially in the beginning, is that you can sort your transactions by category. (You may have to put some work in here initially to make sure each transaction is categorized properly.) Mint can show you wonderful pie charts and bar graphs so that you can scream, “We spent HOW MUCH on frozen yogurt!” or whatever surprise category you find. See where you can cut the fat, so to speak. Maybe you didn’t realize that you spend much more than the average American on cable TV and have some leverage to call the cable company to get on a lower priced plan or vow to cut the cord. Mint makes it possible to see those outliers and trim up your budget accordingly.

No Two Budgets Are Alike

You can begin to build a budget that fits your family’s needs once you have an idea of where your money is going. It should be tight enough to allow for your family’s goals, but loose enough for those unexpected expenses everyone encounters. It should include a plan to pay off any debt you carry, and an emergency fund of at least a couple of thousand dollars. If you find that you cannot make it balance, you may need to make some tough decisions to make deeper cuts or even come up with a plan to increase your earnings. It’s okay, because this is for your future and your present at the same time. Make time to do this. It’s very important.

Goodbudget

Once you have a spending budget, try out Goodbudget. It’s an app and a website to help you track your weekly spending. Most budgeting sites will recommend using a cash envelope system in order to keep your discretionary spending in check. Well, I can’t recommend that because my system is based on strategic spending with credit cards. I actively avoid using cash so that I can maximize my credit card rewards. Goodbudget is set up with virtual envelopes so that you can use the envelope system but still reap the benefits of a rewards credit card for your purchases. We have a four envelope system: Food, Entertainment, Gas, & Miscellaneous. You can customize your envelopes to fit your family’s needs.

Make Time

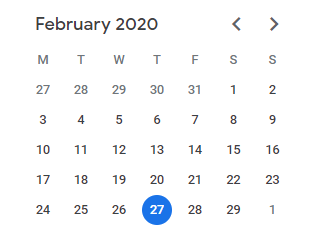

Now you have to manage it. Make an appointment with yourself to log in to your Mint account at least every two weeks. Put it on your calendar or somehow set yourself a reminder. Download the Goodbudget app for everyone that spends from your budget, including your spouse, partner, and older kids. Get in the habit of entering each of your envelope transactions as soon as you spend the money. If you can’t do that, hold onto the receipt until you do.

Open Communication

Lastly, don’t be afraid to discuss aberrations in the budget. Our society has been conditioned to avoid talking about money. Buck the system! At the beginning of this process, you will probably have lots of discussions in your family about where your money is going. Welcome this! Just make sure you keep it respectful, of course. Not everyone is going to agree, and you may have to come to more than one compromise. Some families find it easier to give each member (even adults) personal allowances to help them manage their spending without judgement. You do you!

Are you ready to overhaul your budget and reign in your spending?